"Experienced buyer & investor bump in key detached housing markets signals watershed moment

Detached home values climb in over 80% of Fraser Valley communities; 70% of Greater Vancouver; and 40% of the GTA’s 905 areas

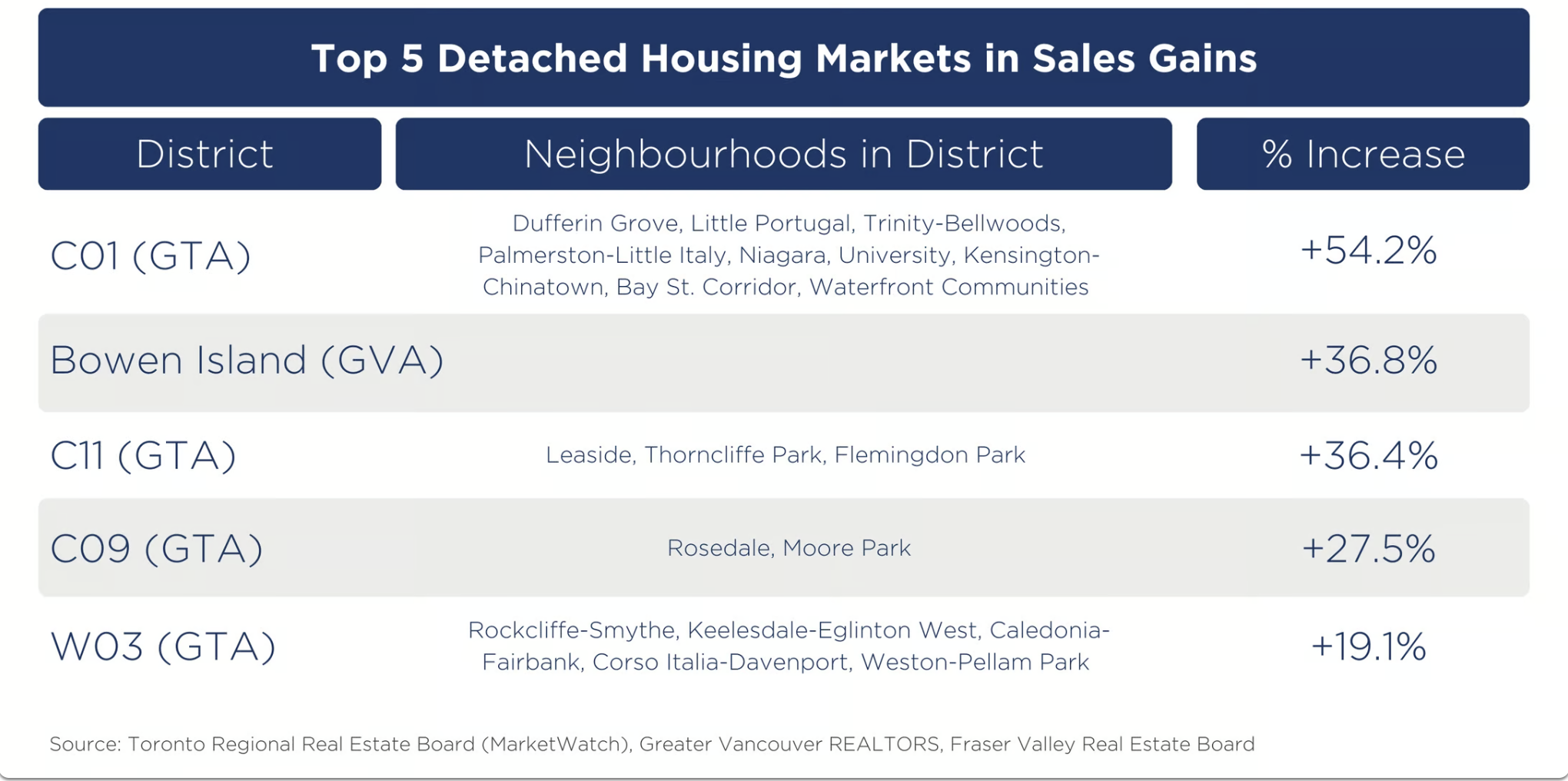

With first-time buyers locked out of the country’s most expensive housing markets, move-up/down buyers and investors have been fuelling detached home-buying activity in the first six months of 2024 in the Greater Toronto Area (GTA), Greater Vancouver Area (GVA) and Fraser Valley. RE/MAX surveyed 83 communities across the GTA, the GVA and the Fraser Valley, and found that 30 per cent reported an upswing in the number of detached housing sales in the first half of the year (25/83), while close to 40 per cent of markets (33/83) reported an increase in values. Toronto detached homes led the other regions in rebounding sales momentum, with just over 34 per cent of neighbourhoods in the 416 experiencing stability or growth in buying activity — ahead of the 905, Greater Vancouver and Fraser Valley. Meanwhile, detached price appreciation was led by Greater Vancouver and the Fraser Valley, driven by limited inventory levels. Fraser Valley took the lead, with 83.3 per cent (5/6) of local areas noting an upswing in average price, followed by Greater Vancouver, which saw median values increase in 70.6 per cent of neighbourhoods.

Detached Home Sales Swing in Greater Toronto Housing Market

“While affordability remains the top obstacle for first-time homebuyers, more experienced buyers and investors are taking advantage of softer housing values, making their moves ahead of the Bank of Canada’s end to quantitative tightening,” says RE/MAX Canada President Christopher Alexander. “Pent-up demand continues to build, with an estimated 20,000 to 25,000 buyers currently lying in wait in the GTA, and another 5,000 buyers in the Greater Vancouver area ready to pull the trigger. The first interest rate cut in June did little to incentivize buyers, but early indications show the second may have struck a nerve.”

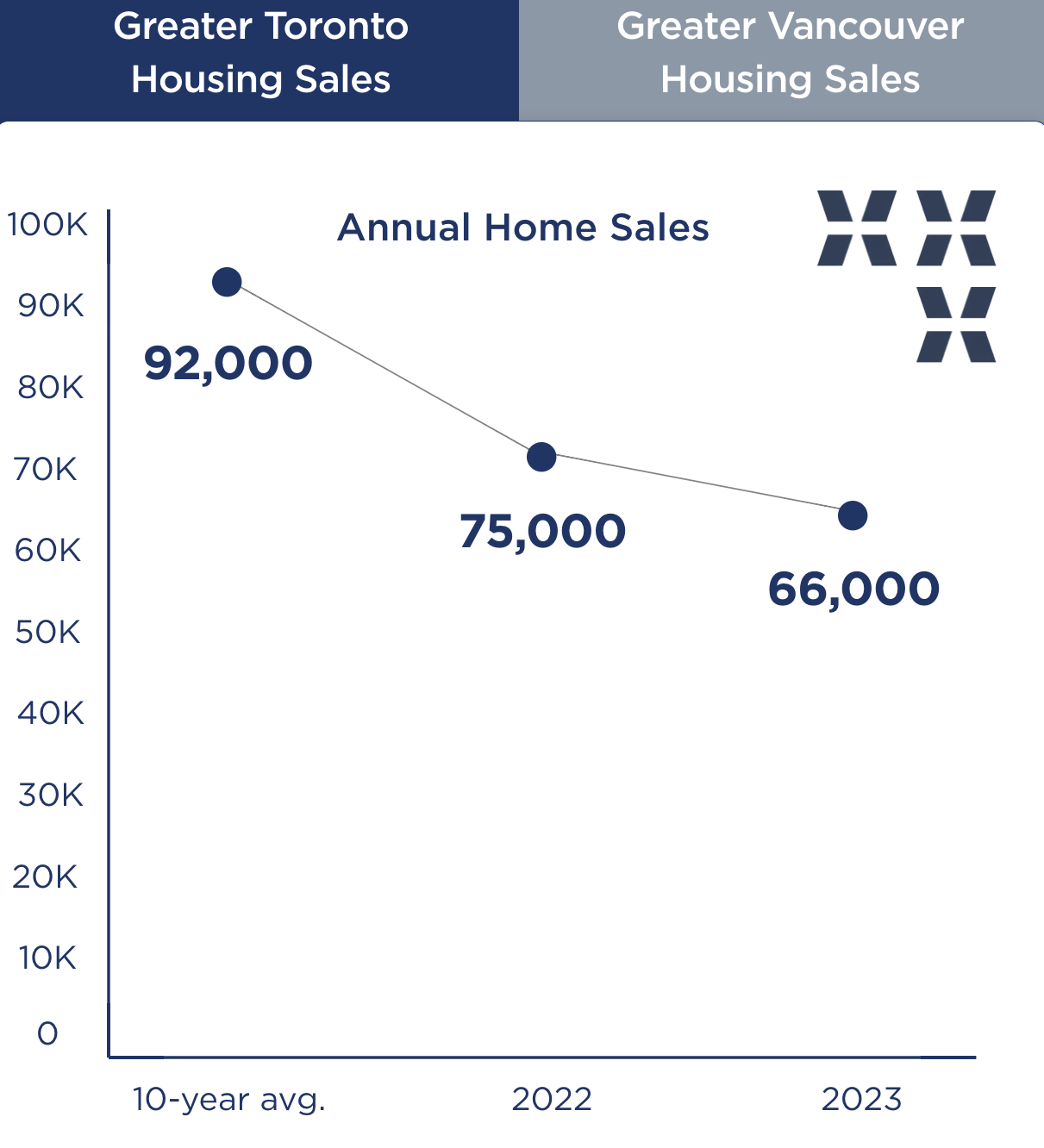

To illustrate, the 10-year average for sales in the Greater Toronto area is just over 92,000 annually. Given the drop to 66,000 sales in 2023, and just over 75,000 homes sold in 2022, the region’s real estate market has seen a shortfall of 43,000 sales during the past two years alone. The same argument can be made for the Greater Vancouver Area, where annual sales have typically averaged over 33,000 during the past decade. Over 26,000 homes sold in 2023, while close to 29,000 homes sold in 2022 – a shortfall of about 11,000 transactions.

Greater Toronto Housing Sales

“Buying intentions slowed, while new household formation, lifecycle events, immigration and population growth have continued,” says Alexander. “The right conditions will undoubtably unleash demand. Meantime, certain neighbourhoods have proven stronger than others.”

In the Greater Toronto real estate market, pockets that posted notable percentage gains in home-buying activity include Dufferin Grove, Little Portugal, Trinity-Bellwoods, Palmerston-Little Italy, Niagara, University, Kensington-Chinatown, Bay St. Corridor, Waterfront Communities (C01); Oakwood Village, Humewood-Cedarvale, Yonge-Eglinton, Forest Hill South (C03); Rosedale-Moore Park (C09); Leaside, Thorncliffe Park, Flemingdon Park (C11); Rockcliffe-Smythe, Keelesdale-Eglinton West, Caledonia-Fairbank, Corso Italia-Davenport, Weston-Pelham Park (W03). “Vibrant downtown/midtown communities remain a perennial favourite among purchasers in Toronto, who are vying for detached properties in coveted blue-chip neighbourhoods such as Rosedale-Moore Park, Forest Hill South, the Kingsway, Leaside, and The Beaches, as well as gentrified areas including Trinity-Bellwoods, Palmerston-Little Italy, and Corso Italia-Davenport,” says Alexander.

In the Greater Vancouver real estate market, detached home sales were led by Bowen Island, which experienced a 36.8-per-cent upswing, followed by West Vancouver/Howe Sound at 8.7 per cent; Sunshine Coast at 6.7 per cent; Port Coquitlam at three per cent; and Maple Ridge/Pitt Meadows at 2.7 per cent. North Delta was the only market in the Fraser Valley to report an increase in detached home sales, rising 6.4 per cent over year-ago levels for the same period. “Recreational communities are represented in the top markets in the GVA, with many buyers seeking to combine the joy of nature with access to the city. Areas such as the Sunshine Coast and Squamish in particular are experiencing a strong uptick in recent years that is also lifestyle driven,” explains Alexander, adding that Bowen Island has increased in popularity, but is only accessible by ferry, making it a true recreational destination.

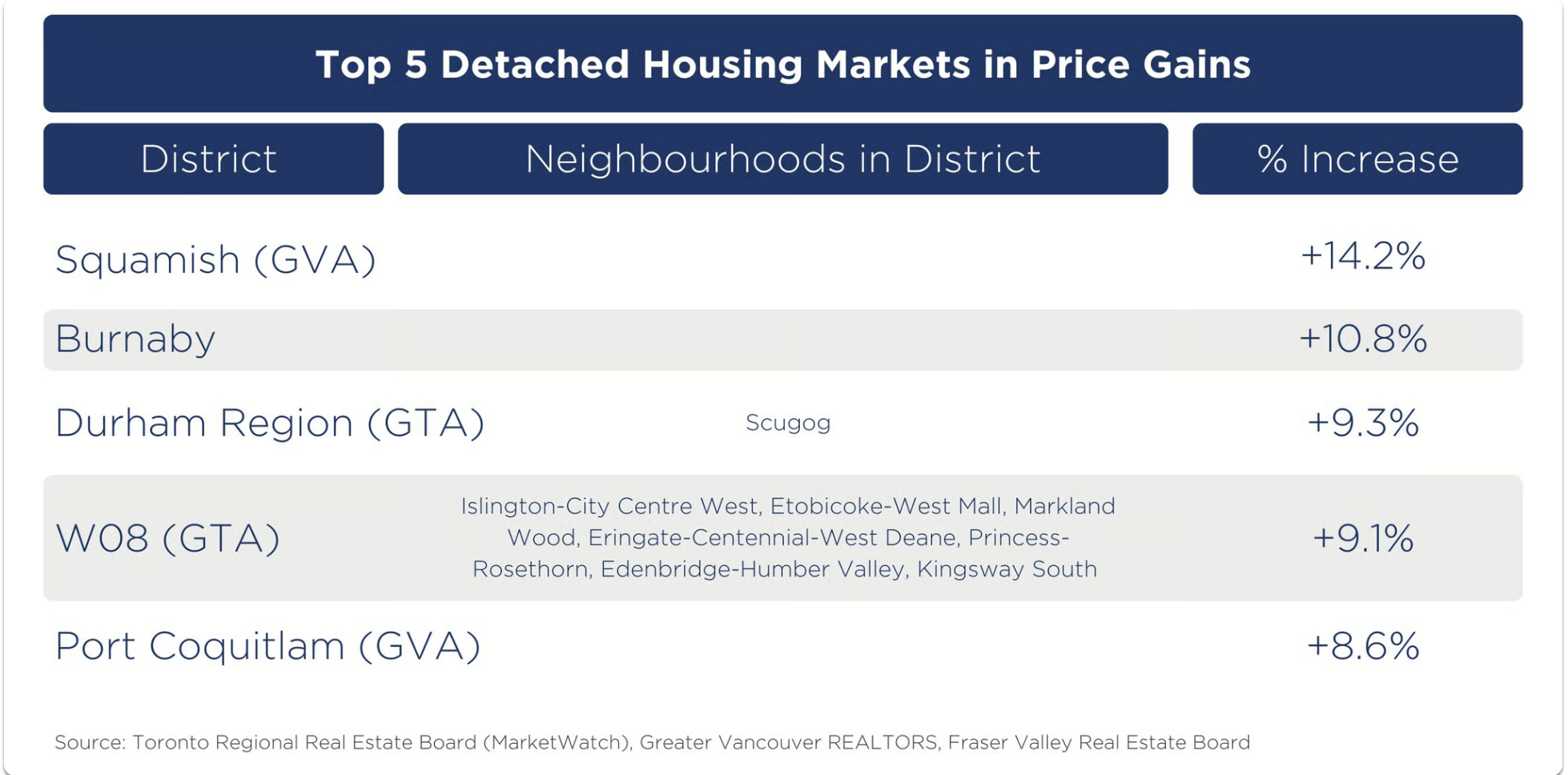

Price Gains Led by Fraser Valley & Vancouver Housing Markets

Fraser Valley and Greater Vancouver detached homes stood out in terms of median values the first half of the year, with increases reported in Squamish (+14.2 per cent to $1,570,000), Burnaby (+10.8 per cent to $2,160,000), and Port Coquitlam (+8.6 per cent to $1,465,000). Other pockets reporting rising median prices included North Vancouver (+8.3 per cent to $2,275,000), Richmond (up five per cent to $2,100,000), Vancouver East (+4.6 per cent $1,974,950); and Whistler-Pemberton (+3.4 per cent to $2,350,000). In the Fraser Valley, more nominal increases were posted in Abbotsford, Mission, White Rock/South Surrey, Langley, North Delta, and the City of Surrey, ranging from 0.08 to 3.3 per cent.

In the Greater Toronto Area, 40 per cent of communities in the 905 reported an upswing in average price, with the highest gains reported in Scugog in Durham Region (9.3 per cent to $1,090,069) and Stouffville in York Region (six per cent to $1,641,821). Upward trending, albeit more moderate, was also reported in detached house values in York Region—Aurora (2.6 per cent to $1,707,177), Newmarket (1.7 per cent to $1,362,331), Richmond Hill (0.8 per cent to $2,009,410); Durham Region—Brock (0.2 per cent to $766,933), Uxbridge (4.6 per cent $1,433,054); and Halton Region—Burlington (2.2 per cent to $1,480,854), Halton Hills (1.7 per cent to $1,230,986), and Oakville (0.7 per cent to $2,042,863). In Toronto Proper, almost 29 per cent (10/35) of markets registered upward momentum in detached housing values. Toronto’s West End led in terms of rising housing values, with five of 10 neighbourhoods experiencing an upswing in average price. The highest increase was noted in the Kingsway South, Princess-Rosethorn, Edenbridge Humber Valley, Islington-City Centre West, Etobicoke-West Mall, Markland Wood, and Eringate-Centennial-West Deane (W08) where detached values rose 9.1 per cent to $1,824,330, followed by High Park North, Junction Area, Runnymede-Bloor West Village, Lambton-Baby Point, Dovercourt-Wallace, and Emerson Junction (W02) at 7.8 per cent to $1,751,504. The Beaches, Woodbine Corridor and East-End Danforth (E02) rounded out the top three markets in the 416, jumping 6.3 per cent to $1,897,167.

Trend – spotting:

1 Disenchanted condominium investors have shifted their attention

to detached homes on small lots in the GTA’s east end. A joint report on investor losses, from Urbanation and CIBC Economics, found that on average, condo investors who closed on their newly completed units in 2023 saw negative cash flow of close to $600 per month. Given that statistic, it’s not that surprising that investors are revisiting their investment options.

2 Empty nesters and retirees in Halton Region are buying bungalows

—many with attached two-car garages on good sized lots—for future use and renting them out in the interim.

3 Blue-chip neighbourhoods remain robust, with buying activity up

in Leaside, Rosedale, and the Kingsway, compated to year-ago levels. The Beaches and Vancouver West experienced an uptick in detached values year-over-year.

4 Chronically undersupplied micro-markets in Toronto’s downtown

and midtown areas are experiencing healthy demand, with multiple offers a frequent occurrence. Unlike 2021 and 2022, accepted offers were rarely over list price.

5 An influx of buyers into West Vancouver/Howe Sound is attributed

to an anticipated uptick in housing values as the Bank of Canada (BoC) winds down its quantitative tightening mandate.

6 Durham Region is the most affordable area for detached homes

in the GTA, with average prices under $1 million in multiple communities. Softer housing values north of the GTA have sparked an increase in demand in more affordable areas including Newmarket and Stouffville.

7 Trade-up buyers are taking advantage of lower housing values to

take the next step in home ownership, especially in the top end of the GTA. Detached housing sales over the $5-million price point in the Greater Toronto Area are up close to 19 per cent, with 127 detached sales reported in the GTA in the first six months of the year, compared to 107 sold during the same period in 2023.

8 Taxes remain an obstacle, particularly in Greater Vancouver, where

both residents and non-residents are faced with the city’s empty house tax. On a vacant $1.5-million property that is not a principal residence, the 3.5 per cent rate would bring the annual tax bill to $52,500 (3 per cent city/0.5 per cent province). The cost would be even greater for a foreign owner or satellite family.

9 Some investors in the GVA are upscaling their principal residences

in lieu of purchasing investment properties to circumvent the recently implemented capital gains increase."

Source: https://blog.remax.ca/detached-houses-toronto-vancouver/